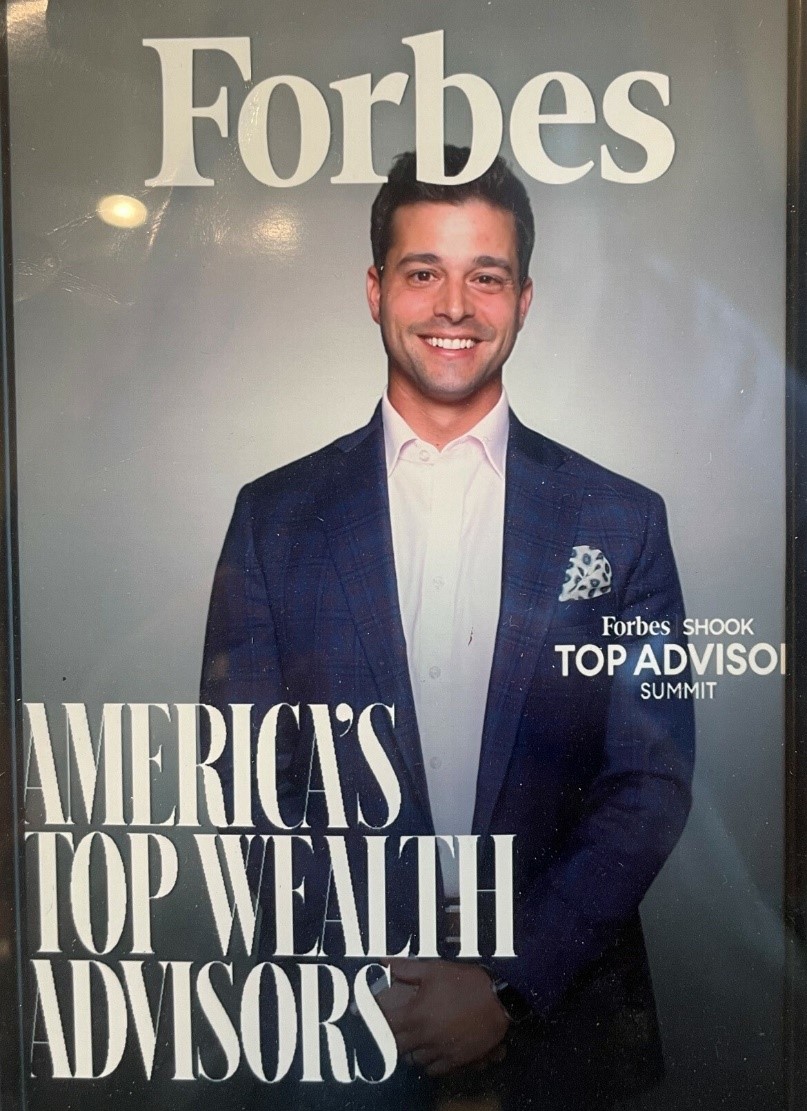

Tyler Gugliuzza of Louisiana

Tyler Vincent Gugliuzza, Financial Planner

Tyler Gugliuzza’s ideal client is someone who recognizes the importance of a holistic, data-driven approach to financial planning. This comprehensive process involves a detailed examination of all aspects of a client’s financial picture, including assets, liabilities, cash flow, insurance, investments, tax, and estate considerations. Beyond the numbers, Tyler places a strong emphasis on understanding what is most important to his clients – their families and overall quality of life.

Background and Expertise

Tyler Vincent Gugliuzza’s educational background is extensive and perfectly suited to his role. He holds a bachelor’s degree in small business/entrepreneurship and a Master of Science degree in personal financial planning.

His professional credentials include the Accredited Asset Management Specialist™ (AAMS) and Chartered Retirement Planning Counselor™ (CRPC) designations. Tyler is also a Certified Financial Planner™ (CFP) and holds the Certified Exit Planning Advisor® (CEPA) and Certified Private Wealth Advisor® (CPWA) designations from Yale School of Management and the Investments & Wealth Institute.

With over 12 years of experience in various key leadership roles, Tyler Gugliuzza became a limited partner with his firm in 2014. His expertise and dedication to his clients have earned him recognition from Forbes as one of the Best-in-State Wealth Advisors in 2022, 2023, and 2024, and as a Next-Gen Best-in-State Wealth Advisor in 2022 and 2023.

The Team

Tyler Vincent Gugliuzza’s team is integral to the high level of service provided to clients. Several of his associates have been honored by attending the BOA Managing Partner’s Conference, which celebrates the contributions of some of the firm’s most successful practices.

Personal Life

Tyler and his wife, Leslie, reside in Louisiana with their three children – Grayson, Connor, and Sadie. The family stays busy with various extracurricular activities. Tyler Vincent Gugliuzza is also an active community member, serving on the board and finance committee for Habitat for Humanity. Additionally, he is a proud member of the Financial Planning Association, the Investments & Wealth Institute, and the Exit Planning Institute.

Holistic Financial Planning

As a personal financial advisor, Tyler Gugliuzza of Louisiana believes in investing time to understand what clients are working toward before they invest their money. This involves working closely with clients and their CPA, attorney, and other professionals to determine the most appropriate financial strategy. Whether it’s budget planning to prioritize cash flow, planning for retirement, developing a retirement distribution strategy, or preserving wealth, Tyler dedicates the necessary time and energy to discover what is most important to each client.

Focus Areas

- Budget and Cash Flow Planning: Tyler Gugliuzza helps clients create realistic budgets that prioritize cash flow, ensuring that they can meet their current needs while also planning for the future.

- Retirement Planning: He assists clients in developing comprehensive retirement plans that include saving strategies and retirement distribution plans to complement other sources of income.

- Wealth Preservation: Tyler Vincent Gugliuzza works with clients to create strategies that protect and grow their wealth, taking into account their unique goals and risk tolerance.

- Tax and Estate Planning: Collaborating with CPAs and attorneys, he ensures that clients’ tax and estate plans are optimized for their financial situation and future goals.

Mentorship and Community Involvement

Tyler Gugliuzza of Louisiana is passionate about giving back to the community and mentoring the next generation of leaders. His work with Habitat for Humanity and various financial associations underscores his commitment to improving the lives of others through financial education and support.

Achievements of Tyler Vincent Gugliuzza

Tyler’s achievements are a testament to his dedication and expertise. Being named to Forbes Best-in-State Wealth Advisors for multiple years and recognized as a Next-Gen Best-in-State Wealth Advisor highlights his commitment to excellence in financial planning.

His approach to financial planning is holistic, comprehensive, and deeply personalized. By focusing on every aspect of his clients’ financial lives and understanding their personal values and goals, Tyler ensures that each financial strategy is tailored to help them achieve their dreams. His extensive education, professional credentials, and community involvement make him a trusted advisor and an invaluable asset to his clients.

Creating a Succession Plan for Family-Owned Businesses: A Comprehensive Guide

Family-owned businesses are the backbone of many economies, providing jobs and services while embodying values of hard work, tradition, and entrepreneurship. However, one of the biggest challenges these businesses face is ensuring a smooth transition from one generation to the next. Without a solid succession plan, family businesses risk internal conflict, operational disruptions, and potential financial losses. Tyler Gugliuzza discusses more on the essential steps in creating a succession plan for family-owned businesses, ensuring longevity and stability for future generations.

The Importance of Succession Planning

Succession planning is not just about choosing a successor. It’s a comprehensive process that ensures the business continues to thrive even as leadership changes. Here are some key reasons why succession planning is crucial:

- Preserves Business Continuity: A well-thought-out plan ensures that the business remains stable and continues to operate smoothly during transitions.

- Reduces Conflict: Clearly defined roles and expectations can prevent disputes among family members.

- Protects Wealth: Effective succession planning helps safeguard the family’s wealth and business assets.

- Ensures Leadership Quality: Identifying and grooming the right successor helps maintain strong leadership.

Key Steps in Creating a Succession Plan

Start Early

Succession planning should begin well before the current leader intends to step down. Ideally, this process should start 5-10 years in advance. Early planning allows for a more thoughtful approach and provides ample time to groom potential successors.

Define Your Vision and Goals

Before selecting a successor, it’s essential to understand the long-term vision and goals of the business. Engage family members and key stakeholders in discussions about the future direction of the company. Consider questions like:

- What are the long-term goals for the business?

- How do family values and traditions fit into the business strategy?

- What are the financial objectives?

Identify Potential Successors

Selecting the right successor is crucial. This person should not only have the necessary skills and experience but also the respect and support of family members and employees. Consider the following:

- Does the candidate have the required business acumen and leadership skills?

- Is the potential successor genuinely interested in leading the business?

- What additional training or experience might they need?

It might be beneficial to look both within and outside the family to find the best candidate. Sometimes, a non-family member might be better suited to lead, with family members retaining ownership roles.

Develop a Training and Transition Plan

Once potential successors are identified, create a comprehensive training plan. This might include:

- Mentorship: Current leaders should mentor successors to share insights and experience.

- Formal Education: Encourage successors to pursue relevant courses or certifications.

- Gradual Responsibility: Slowly increase the successor’s responsibilities to ensure they are well-prepared.

Establish Clear Governance Structures

Define roles, responsibilities, and governance structures to ensure clarity and reduce potential conflicts. Tyler Vincent Gugliuzza suggests establishing:

- Family Council: A forum where family members can discuss business matters.

- Board of Directors: Including non-family members can provide unbiased perspectives.

- Employment Policies: Clear policies about family member employment, promotions, and salaries.

Plan for Ownership Transfer

Transferring ownership can be complex, involving legal and financial considerations. Work with legal and financial advisors to:

- Determine the Best Structure: Options might include outright sale, gradual transfer, or trust arrangements.

- Address Tax Implications: Plan for potential tax liabilities to avoid unexpected costs.

- Create Buy-Sell Agreements: These can outline terms for buying out family members who wish to exit the business.

Communicate the Plan

Transparent communication is vital for the success of the succession plan. Share the plan with all stakeholders, including family members, employees, and advisors. Regular updates and open discussions can help manage expectations and build support for the chosen successor.

Regularly Review and Update the Plan

A succession plan should not be static. Regularly review and update the plan to reflect changes in the business, family dynamics, and external environment. This ensures the plan remains relevant and effective.

Conclusion

Creating a succession plan for a family-owned business is a complex but essential task that ensures the business’s continuity and success across generations. By starting early, clearly defining goals, identifying and training potential successors, and establishing clear governance and communication structures, family businesses can navigate the transition smoothly. Ultimately, a well-crafted succession plan preserves the legacy of the family business, ensuring it thrives for many years to come.

To connect with Tyler Gugliuzza of Louisiana and for articles on various financial topics, such as budgeting, planning, asset allocation, business and personal finance, estate planning, retirement and more, follow along at his blog.